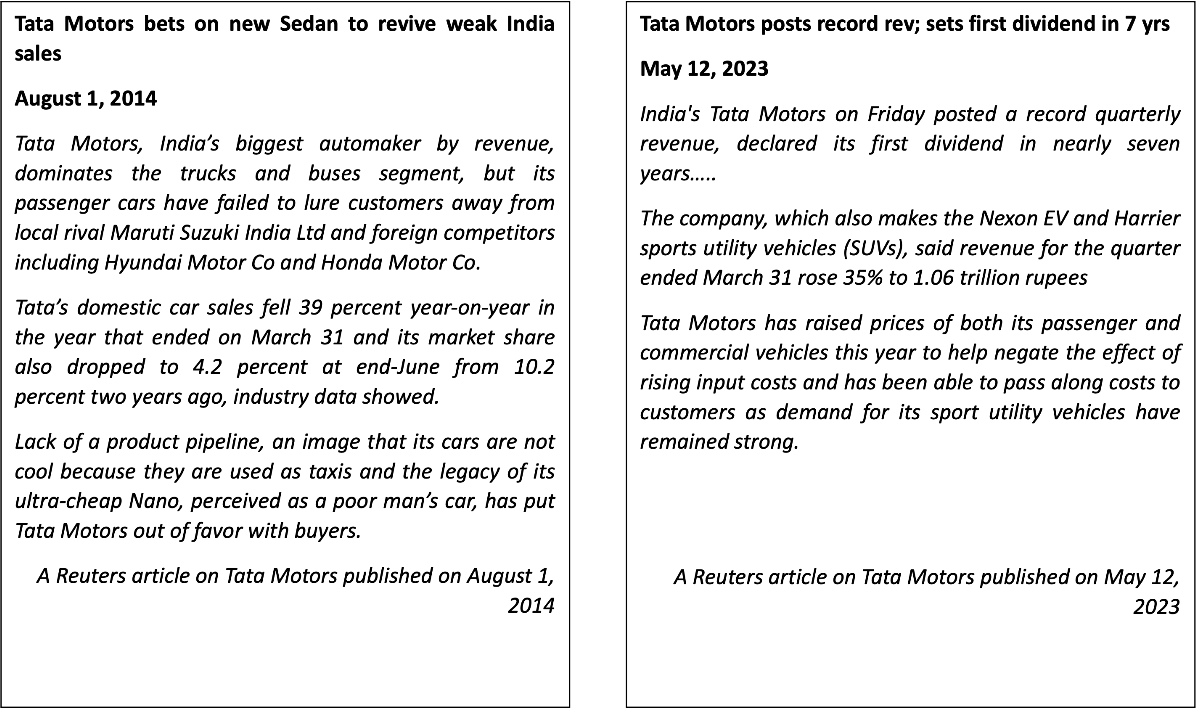

Headlines matter. They are a succinct indicator of the current and future outlook for a brand. And in the case of Tata Motors’ passenger vehicles (PV) segment, there is a marked difference between the tonality of headlines today vs. those about a decade ago: 1¹,²

Below excerpt from Tata Motors FY’22 annual report indicates that there is a good reason for this optimism:

“Overall domestic market share (in PV Segment) increased to 12.1% (+390 bps vs FY21) and further to 13.4% in Q4 FY22. The Passenger Vehicles segment grew volumes by 67%, revenues by 90% and EBIT margins improved by 750 bps with positive free cash flows in FY22. In Electric Vehicles, new records were set every quarter to register the highest ever annual EV sales of 19,105 units in FY22 (up 353% vs FY21) with penetrations touching 7.4% by Q4 FY22”.

While Tata Motors of 2014, coming fresh after the Nano debacle, was battered and bruised, the 2023 Tata Motors seems to be a different beast altogether- one that’s future-ready and raring to go. This ‘turnaround’ isn’t a fluke fueled by extraneous factors. Instead, it’s rooted in strong fundamentals set up by the brand over the long term that have started yielding results over the last 3-4 years. Tata Motors is a story of learning from losses and proactively preparing for the consumer trends that would shape the future of the category.

The changing car consumer landscape

For Indian consumers, car and home are markers of financial and personal maturity. Like a home, the decision to buy a car is multivariate, and brand choice is driven by rational, emotional and social factors. Today besides criteria like comfort, capacity, cost, fuel economy, after-sales service and resale value, additional variables like aesthetics (the overall body design, the look & feel), connectivity (voice controls, car tech), safety (features and certifications), sustainability (adherence to latest emission guidelines) and driving pleasure (the comfort of driving on rough roads and easy manoeuvrability) have also become important choice drivers.

There is also an interesting trend of the rise of SUV share in the Indian PV industry. SUVs, traditionally associated with brute & raw display of power- a lot of which had to do with their rather bulky, boxed & bloated designs- have now become a vehicle of choice by offering a more comfortable drive experience, better space (especially for outstation leisure trips) and compelling, slick designs. The launch of feature-rich, well-designed SUVs at a variety of price points that are suitable for both in-city as well as out-of-city travels has further fueled this trend.

As per data from industry sources, the share of SUVs in overall Indian PV sales has consistently increased over the last three years to overtake hatchbacks in 2022. Sales of hatchbacks in India in 2022 stood at 1.24 million versus SUVs at 1.47 million units.

Further, car purchase decisions have become increasingly omnichannel. While perceived popularity and word of mouth continue to be important drivers, consumers also use Google, YouTube and online aggregators to explore, shortlist, and compare the alternatives and make the best possible choice.

Net, over the last few years the Indian automobile industry has become more competitive and cluttered, and consumers have become better researched & more demanding. While brand reputation and popularity matter, the product remains the undisputed hero. Tata Motors took cognizance of these trends and chalked out a long-term plan to win.

Gearing up for a turnaround

”A good product is the best form of marketing”- this brand-building maxim applies nowhere better than the automobile industry. Buyers closely examine product nuances to get the best deal within their budget. While every buyer is open to listening to brands- both new and old- established perceptions can be a big mental roadblock impeding consideration.

Tata Motors, a victim of an array of legacy perceptions- ranging from ‘taxi vehicles’ to ‘cheap cars’ to ‘poor quality’ had a tough task at hand. The company realized that no amount of marketing arsenal could turn around its fortunes. Its product had to do the talking and become the de-facto ambassador.

The brand took this challenge head-on and took a long and hard look at all consumer-relevant moments of truth. It launched several initiatives that would fundamentally change the established perceptions and make consumers reconsider its offerings:

1. Reinventing the DNA- a new architecture platform: elemental to car manufacturing, in automobile industry lingo, “platform” is a design architecture that includes the underfloor, engine compartment, and frame of a vehicle. Tata Motors made a fundamental shift by stopping the practice of separate platform designs for each model. Its new Omega platform was based on the Jaguar Land Rover D8 platform- a gold standard for SUVs. This ensured that SUVs from Tata stable would meet the global benchmarks.

D8 platform was optimized for the Indian market using frugal manufacturing techniques to minimize the cost. The Indianized Omega Architecture christened as ‘OMEGARC’, was ready by 2018. It has served as the base for the launch of highly successful TATA models, including Harrier and Safari.

2. Redefining the aesthetics- Impact Design 2.0: while the new platform would transform the way the car drives and was indeed a great first step to reframe perceptions and make consumers reevaluate its vehicles, Tata Motors had to ensure that the new-gen vehicles stand-out at the very first look. TATA didn’t just have to differentiate its offerings from the competition, it had also to ensure that its offerings stood apart vs. its own past designs. Tata would need to change the design language of its vehicles.

This thought underpinned the project called Impact Design 2.0- a newer version of Impact Design Philosophy, which stood for creating ‘Immediate IMPACT at first sight. Lasting IMPACT over time’. IMPACT Design 2.0 is intended to be a sharper, more contemporary expression of Tata Motors’ Design language, which “captures the attention of the viewer in the first few seconds by being recognizable, memorable and above all stunning.”

A very interesting and nuanced design language that covered both the Interiors and Exteriors of the vehicle, the new design philosophy aimed to create exteriors that are “Expressive, Exciting and Extraordinary” while Interiors that are replete with “Inviting, Intelligent and In-touch” features. This design philosophy ensured minute attention to detail- differentiating the new offerings.³

3. Revamping the channel & aftersales- Reimagine PV Strategy: while architecture and design would lead to a well-differentiated product that’s free from legacy perceptions, the brand also needed to ensure that it doesn’t falter on channel experience and aftersales- two important moments of truths for a car brand.

As a part of its ‘Reimagine PV Strategy’, Tata put the spotlight on rejuvenating the front-end sales system, dealership network and customer experience. This was very important- with years of stagnating sales, the channel motivation was low, discounting was a norm, and there was a channel cynicism that could be deleterious to the brand’s efforts to reclaim market share.

The project started with an intensified engagement with its dealers, educating them about the new launches and their features. TATA also launched a service initiative called EzServe that would leverage 2-wheelers equipped with an elaborate kit containing three utility boxes mounted on the bike’s rear. These boxes were packed with spare parts, a vacuum cleaner, a jack & jack stand, and several hand tools for providing minor repairs and scheduled service at customers’ doorstep, esp. in remote areas.

For its passenger vehicle owners, Tata Motors also launched a Service Connect App that allowed them to connect with Tata Motors for their after-sales needs. Features like online service booking, pickup requests, updates on vehicle repair status, viewing of repair estimates for scheduled jobs etc., intended to enable consumers to keep track of all of their service needs corresponding to the Tata vehicle owned by them. Financing options were also revamped in collaboration with Tata Finance to offer options with low EMIs, longer tenures, and up to 100 per cent on-road funding.

With the above initiatives, TATA presented itself as a dynamic and new-age PV company with a seamless and digitized consumer journey experience.⁴

Riding full throttle

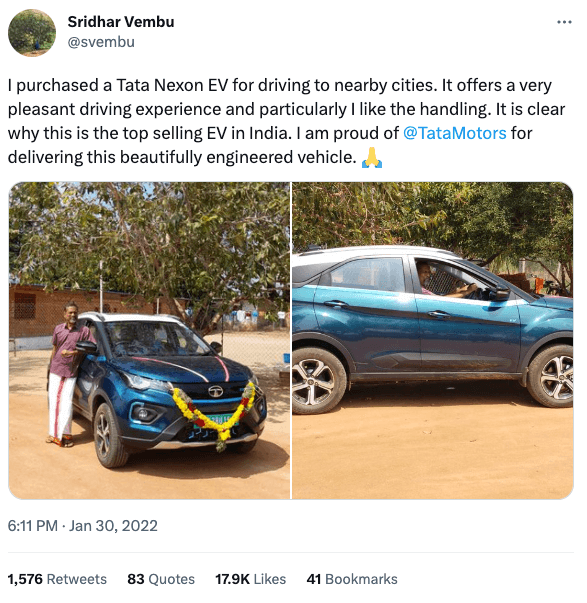

These initiatives came together with the launch of Tata Nexon 1.0 in 2017- the brand’s first offering based on Impact Design Philosophy. Launched in the sub-4-meter SUV segment at a very competitive price point, Nexon received good reviews and quickly attracted consumer attention. Since its launch, Tata has constantly reinvented Nexon- introducing Nexon 2.0, the first SUV EV model under Nexon. Since then, Nexon has gone on to become the highest selling Electric based SUV in India.

With Nexon, the Tata Motors PV turnaround story had begun.⁵

Successive launches- Harrier in 2019, Nexon 2.0 in 2020, Safari & Punch in 2021- ensured that Tata fully leveraged its new fundamentals to launch a range of compelling SUVs that catered to all sub-segments of the growing SUV category and started regaining the market share in the passenger vehicle segment. The thought-through product launches also ensured that Tata Dealers had choices to offer to consumers across the price spectrum. Compelling selling points like the Global NCAP crash test’s 5-star rating also helped to close the last-mile sales. Rather than discounting, the dealers were now doing value-based selling- this further enhanced the brand imagery.

In FY21, the company sold 222,025 units of passenger vehicles, a 69 per cent growth in comparison to the year-ago period. In contrast, the country’s passenger vehicle sales in the fiscal fell by 6.2 per cent! In FY22, the brand became 3rd largest SUV company in the Indian market.⁶

Proofing it for future with EV Play

Being proactive and ahead of the consumer evolution curve characterizes a company that’s serious about reviving its fortunes. In the case of Tata Motors, it didn’t just tap into the already visible consumer trends; rather, it proactively prepared itself for trends on the fringe and is today leading them.

With the rise in prices of conventional fuels and government incentives, Tata Motors realized that the trend of Electric Cars would grow and eventually become mainstream. The company also realized that the Electric Car segment as a whole is currently a white space with little competition. Tata decided to leverage this opportunity and take the lead here.

It made its first move by launching Tata Tigor EV- an electric compact Sedan- in 2019. But it was the launch of Nexon EV in 2020 that really caught consumer imagination. Besides being feature-rich, it was also the first EV in India priced under INR 20L with an SUV form factor and a usable driving range. Tata updated Nexon EV with more power and a better range in 2021 with the Max variant. Going forward, Tata plans to launch EVs based on new-gen ICE (Internal Combustion Engine) architecture, which would give EVs a better form factor.

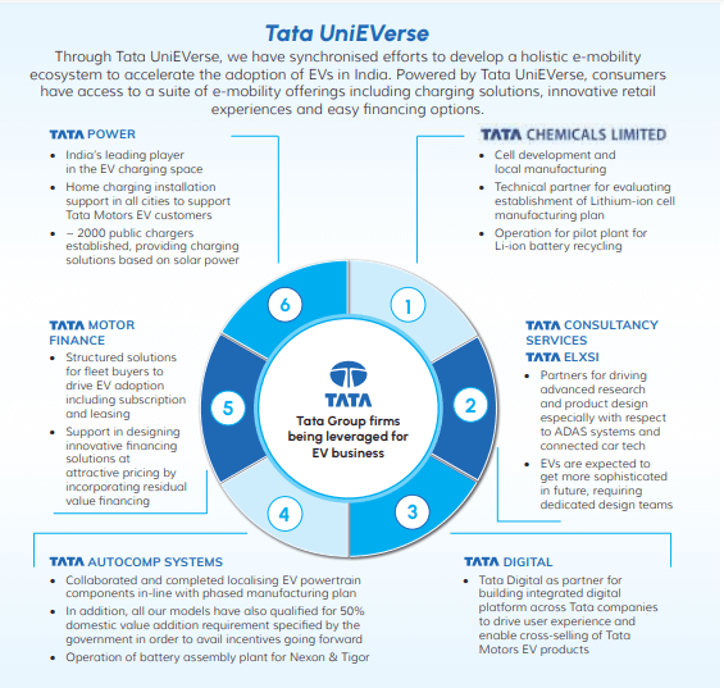

The most remarkable aspect of Tata Motors’ EV play is its ecosystem approach. In FY22, Tata incorporated a separate entity called Tata Passenger Electric Mobility Limited (TPEML) to focus on accelerating the passenger EV business and its enabling ecosystem. Below snapshot from its FY’22 annual report is a good summary of the approach of bringing diverse companies in Tata Group together and leveraging the synergies to gain leadership in the EV space:

In FY22, Tata Motors EV volumes grew by 353% vs. last FY; EVs contributed approximately 8% to its overall PV sales. Tata Motors had a market share of 87% in the EV segment and continues to lead the EV segment. Of course, EVs have also burnished the company’s image as an innovative and dynamic player in PV space.⁷,⁸

And finally, saying it in communication

Each new launch from Tata Motor stable was accompanied by a 360-degree effort- with high-decibel ATL and Social Media campaigns complemented by BTL efforts like PR, car reviews, collaborations & sponsorships- to highlight its differentiating features. This served the brand well by creating the much-needed initial intrigue for the launch, prodding potential buyers to explore and discover the exciting features of the transformed Tata Motors offerings.

With a great product portfolio in place, Tata Motors launched a campaign that brought together its 3rd-Gen vehicles under the common theme of “New Forever”- and emphasized how Tata Motors has a transformed portfolio that’s future-ready with vehicles that bring together design, rich features and driving pleasure.

“New Forever” has since then become a shorthand in both media and retail to describe the new PV portfolio from Tata and seems to be a savvy marketing move to differentiate its new offerings from the legacy ones.

Potential speedbumps ahead

The new portfolio from Tata Motors has seen a good consumer response and delivered great commercial results, but then, the Indian Passenger Vehicle category isn’t without its share of challenges that impact everyone, including Tata Motors.

The category sentiment as a whole is highly contingent on macroeconomic factors. Coming out of relatively muted sales post-Covid, the PV segment saw healthy growth over the last 2-3 years. However, with economic uncertainties looming on the horizon, the future prospects aren’t as rosy. The competitive intensity in the SUV segment is only likely to intensify, with both home-grown and international players desirous to take a share of the segment pie.

On the EV front, while the company has definitely taken a good lead, it’s a long-term play. The charging infrastructure and car performances have some way to cover before EVs find broader mainstream acceptance. It would require considerable patience and investments before the company gets an RoI. Being a public entity, Tata Motors will need to constantly demonstrate progress on this front to sustain the positive investor sentiment.

However, it’s reasonable to say that Tata Motors has already crossed the patchy roads. Now it needs to carefully cruise to sustain its momentum.

In Conclusion

Tata Motors’ story of losing market share and then slowly clawing back to former glory holds valuable lessons in marketing and brand building.

When faced with consumer apathy, the company did well to go back to the drawing board and make some paradigm shifts rather than relying on cosmetic changes. It required persistence and patience, but it also set it up for long-term success.

Another interesting learning is about revisiting and adding efficiencies at every moment of truth. From product to channel and after-sales experience, Tata Motors brought about a holistic transformation in its business.

Finally, Tata Motors’ story once again reinforces the importance of a collaborative approach. The way Tata, a massive conglomerate, is leveraging cross-functional synergies from verticals as diverse as Tata Chemicals to Tata Consultancy Services to further its EV play is a reminder of the power of the ‘better together’ philosophy.

Sources

- https://www.reuters.com/article/tata-motors-ltd-india-launch/tata-motors-bets-on-new-sedan-to-revive-weak-india-sales-idUSL4N0PW2GE20140731?edition-redirect=in

- https://www.reuters.com/business/autos-transportation/indias-tata-motors-posts-second-straight-quarterly-profit-2023-05-12/

- https://www.tatamotors.com/innovation/design/

- https://www.autocarpro.in/feature/tata-motors-refreshes-customer-focus-81961

- https://www.forbesindia.com/article/take-one-big-story-of-the-day/how-tata-motors-became-indias-thirdlargest-carmaker/68297/1

- https://auto.economictimes.indiatimes.com/news/tata-motors-pvs-climb-new-sales-peak-in-fy22-sees-persisting-chip-supply-issues/90592801

- https://www.bqprime.com/markets/tata-motors-bets-big-on-ev-disruption-strategy-to-drive-growth

- Autocar India – Tata Motors